The future of energy: Views from an industry insider

The future of energy: Views from an industry insider.

May 4, 2022 | By Dean Sevin Yeltekin

Dave Khani spent 20 years on Wall Street before serving as Chief Financial Officer (CFO) of CONSOL Energy from 2013-19. In January 2020, he became the CFO of EQT Corporation, the largest producer of gas in the U.S. To say he knows his way around energy policy and economics is an understatement. Against the backdrop of Russia’s invasion of Ukraine, Dave has generously agreed to weigh in on pressing issues surrounding energy supply chains, affordability, and climate change solutions.

How has Russia’s invasion of Ukraine impacted natural gas prices in the U.S? What challenges or opportunities has it created for energy producers like EQT?

Russia supplies between 20-40% of Europe’s coal and natural gas, which it is now using as a weapon. After undersupplying Europe heading into this past winter, natural gas prices have increased 5-15x ($20-$60 per Dth vs $5 per Dth priced within the US). As a result, Europe is fighting inflation, a loss of stability when it comes to power and heating sources, and a diminished ability to use fertilizer (Natural gas is its major feedstock). Europe’s energy security is threatened to such an extent that the Biden administration will have to confront it in one way or another. The situation is changing our conversations with public officials and with the public about where we need to pivot on commodities and natural gas.

At EQT, we created a global plan to help eliminate emissions from international coal by accelerating the production and export of U.S. liquid natural gas (LNG). Replacing international coal with U.S. natural gas is not only our best weapon to address climate change on a global scale—it's also a strategic tool in crises like these. We have the capacity to double the world’s LNG trade over the next 10 years and export the LNG that Europe needs to offset the disruption caused by Russia’s invasion of Ukraine. But to do so, we need more pipelines approved and export LNG facilities permitted to make it happen. [Note: to transport natural gas overseas, it must be converted into LNG]. Currently, the Federal Energy Regulatory Commission (FERC) has a bunch of facilities in the queue to receive a permit. We’re doing everything we can to accelerate the process, and we expect to participate in exporting gas to Europe.

What are some of the other barriers your company is trying to overcome in decarbonizing the U.S. industrial base?

We are working to educate the public about the best way to go about fighting climate change through energy policy. Right now, there is a prevalent view, particularly in the U.S. and Europe, that solving climate change requires us to reach net zero carbon emissions as fast as possible. The problem is that people are hoping to achieve this through electrification of vehicles and wind and solar renewables. But even if the U.S. and Europe can arrive at net zero, we will never reach our global goals as long as countries like China, India, and Indonesia are burning coal, which accounts for half of global emissions.

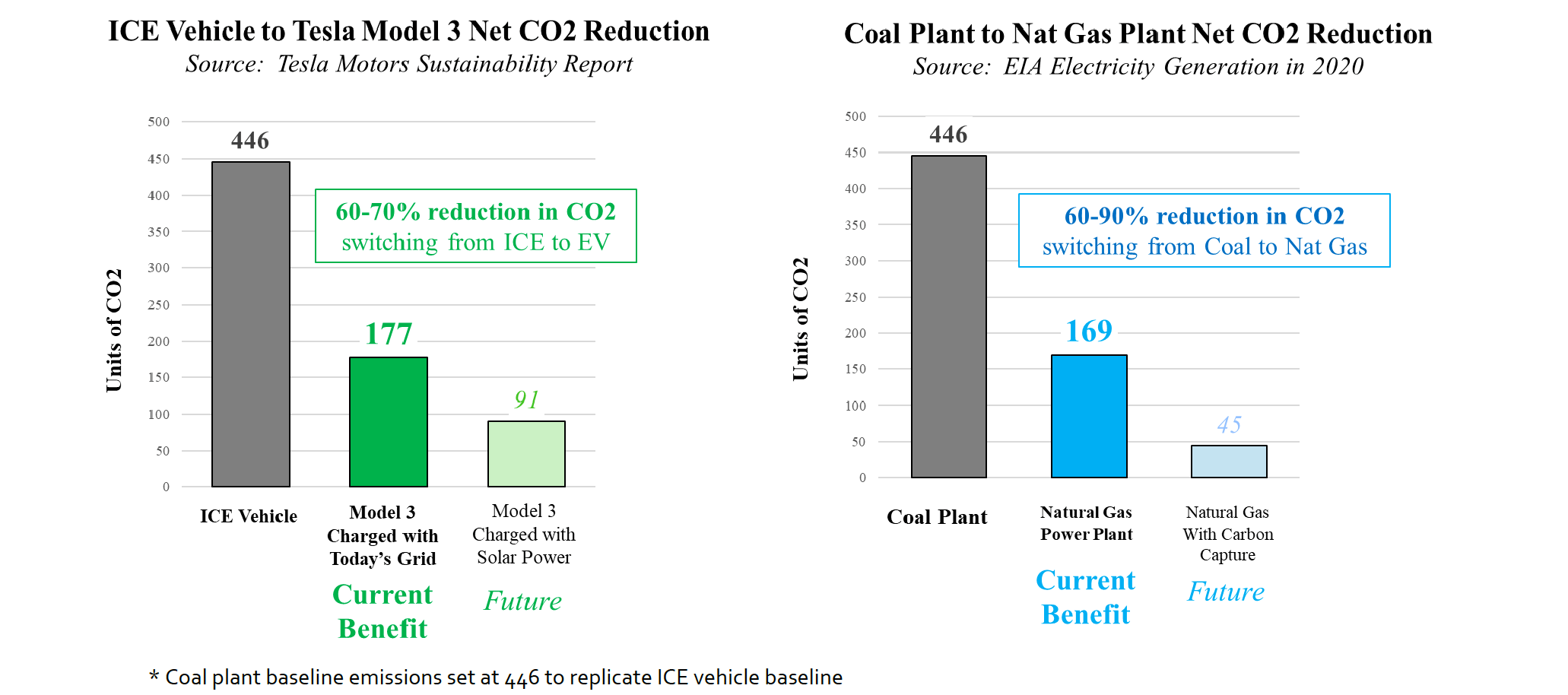

Last year, global coal emissions grew so fast that they essentially wiped out all the U.S. climate emission benefits of renewables installed for the last 15 years. While electrification of vehicles is certainly a worthy endeavor, the emissions reduction achieved by switching from an Internal Combustion Engine (ICE) to an electric vehicle is exactly the same, on a percentage basis, as switching from coal to natural gas within the power sector. The difference is that we can transition from coal to natural gas faster and on a larger scale. Natural gas and LNG provide a faster, greener solution for the world. We have proven this concept here in the U.S., where emissions have declined meaningfully due to natural gas replacing coal.

Last year, EQT set an aggressive emissions reduction plan to hit net zero emissions by 2025. We are well on our way, having already reduced our emissions by over 30% since our new executive team took over in July 2019. We’re trying to solve climate change, not just fight it. We are in a multi-year process to replace over 8,000 of our pneumatic devices on our wells to reduce methane exposure and have hired third party entities to do field measurement and certifications. So not only are we pushing to reduce our emissions, we are also making sure that they are verifiable and trusted by our customers. We have been very public on our process and interact with environmental groups to showcase our plans to aggressively reduce emissions.

Where does nuclear energy fit into this picture?

Nuclear energy is a clean, affordable option, but it takes a long time to get up and running. The U.S. is actually moving away from using nuclear energy and has retired or is retiring facilities in New York, California, and elsewhere. At this point, nuclear energy is a solution that is 10 years away, at minimum, so it’s not the option that gets us where we want to go the fastest. The U.S. also imports as much as 90% of its uranium fuel, some of which comes from Russia, so sourcing its fuel needs to be better thought out to maintain energy security.

What are some trends in ESG investing & reporting you have witnessed in your industry?

The amount of money following ESG is enormous—in the trillions and growing. It’s changing the way that major players in the industry operate. There are now four banks (JPM, Barclays, Bank of America, and Citibank) with new standards on lending based on carbon emissions. Corporations are expected to release ESG or sustainability reports. Those that produce and consume fossil fuels are having to disclose their emissions footprints and how they plan to reduce them. We are starting to see a move toward more standardization in terms of ratings and metrics, but there are still a wide range of ratings systems, which makes goal setting and ratings harder to follow.

One area of concern is that policymakers, often under pressure from environmental groups, are working at the state level to set emissions standards without understanding the economic and the technological feasibility of what they are proposing. They are pushing hard to incentivize renewables and retire all fossil fuels, not differentiating between natural gas and coal. We believe the U.S. lacks the infrastructure or technology to achieve more than 20% market penetration of renewables without sacrificing reliability. It feels like there is sometimes a blind push toward certain ESG goals without adequate governance or accountability. The laws of physics and economics must be obeyed.

What role do you see academic institutions like Simon playing in supporting the mission to produce more environmentally responsible, low-cost energy? What research is needed?

There are countless areas that are ripe for research. Here are a few questions that Simon would be well-positioned to address:

• Do higher ESG scores translate into better long-term stock performance?

• Which ESG standards are optimal? How can we ensure adequate governance surrounding ESG?

• How inflationary is carbon pricing? What are the externalities of trying to capture the cost of carbon in the first place (as is happening in states like California)?

• What is the human cost of energy shortages like the one we witnessed in Texas during the 2021 winter storm?

• How should we weigh the economic benefits of investing in new energy technology versus existing technologies?

• What is the optimal way to diversify energy sources when investing?

What insights would you share with an upcoming MBA graduate who aspires to work in the energy field?

The energy world is undergoing a massive transition. Technology will play a significant role in this, whether it’s how we run our company as a digital work environment or how we apply technology to energy assets. Graduates need to get comfortable with emerging technology, and they should approach the industry with an appetite for change. Energy is not an “old school” field anymore. At ETQ, we have a new ventures group that looks at how we will decarbonize gas for the future beyond the next 10 years. We have also created a digital work environment with a fully remote workforce. We have more IT engineers than we do natural gas engineers. This is an industry that is progressing at an incredible rate. You can't get away from it.

Sevin Yeltekin

Dean, Simon Business School

David Khani ’93S (MBA) is the Chief Financial Officer of EQT Corporation.

Follow the Dean’s Corner blog for more expert commentary on timely topics in business, economics, policy, and management education. To view other blogs in this series, visit the Dean's Corner Main Page.